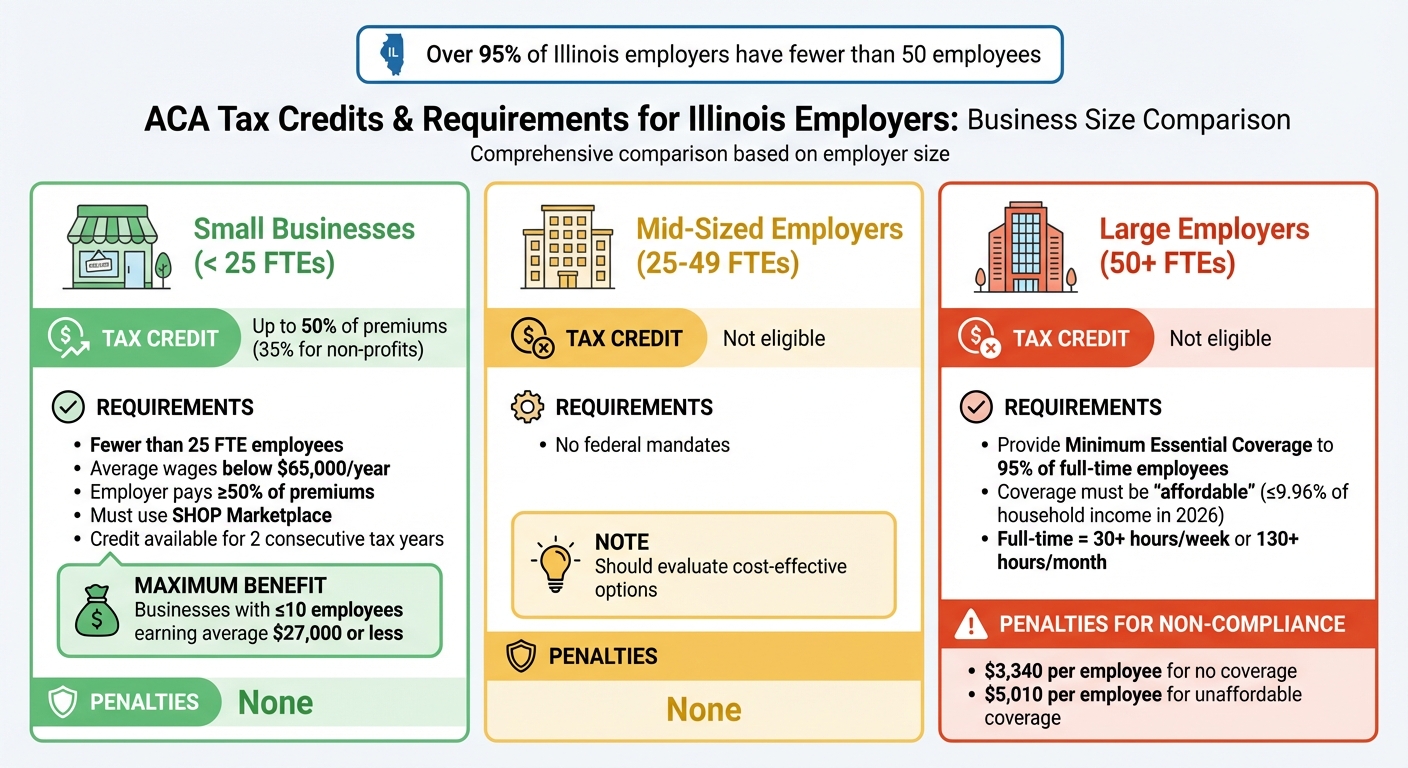

The Affordable Care Act (ACA) provides tax credits and guidelines to help Illinois employers manage health insurance costs. Here’s what you need to know:

- Small Businesses (Fewer than 25 FTEs): Eligible for the Small Business Health Care Tax Credit

, covering up to 50% of premium costs(35% for non-profits). Requirements include:

- Fewer than 25 full-time equivalent (FTE) employees.

- Average wages below $65,000 per year.

- Employer contributes at least 50% of premiums.

- Must use the SHOP Marketplace for insurance.

- Credit available for two consecutive tax years.

- Large Employers (50+ FTEs): Must comply with the ACA’s "pay-or-play" rule:

- Provide Minimum Essential Coverage (MEC)to 95% of full-time employees.

- Coverage must be "affordable" (employee contributions ≤ 9.96% of household income in 2026).

- Non-compliance results in penalties:

- $3,340 per employee for failing to offer coverage.

- $5,010 per employee if coverage is unaffordable.

- Mid-Sized Employers (25–49 FTEs): Not eligible for tax credits or subject to penalties but should still evaluate cost-effective insurance options.

Employers can save money, avoid penalties, and attract talent by understanding these rules. For small businesses, the tax credit can significantly reduce costs, while larger employers should focus on compliance to avoid fines.

ACA Tax Credits and Requirements by Illinois Employer Size

1. Small Business Health Care Tax Credit

Cost Savings

The Small Business Health Care Tax Credit offers a direct way to lower your tax bill. If eligible, you can claim up to 50% of the premiums you payfor employee health insurance – or 35% if you’re a non-profit employer. This can be a big help for Illinois small businesses grappling with rising health care costs.

On top of the credit, you can still deduct any leftover premium costs, adjusted by the credit amount. Plus, if you don’t use the full credit in one year, you can carry it back to the previous year or forward for up to 20 years.

Eligibility Requirements

To qualify, your business must have fewer than 25 full-time equivalent employees (FTEs) with an average annual wage of about $65,000 per employee. You also need to contribute at least 50% of the premium costsfor your full-time employees, and that percentage must be applied consistently across all enrolled employees.

The credit is only available through the Small Business Health Options Program (SHOP) Marketplace, and you can claim it for a maximum of two consecutive taxable years. Businesses with fewer than 10 employees earning an average of $27,000 or lessget the largest benefit. Keep in mind that two half-time employees count as one FTE. To claim the credit, you’ll need to file Form 8941 with your annual tax return.

Meeting these requirements doesn’t just qualify you for the tax credit – it also makes your business more attractive to potential employees.

Impact on Employee Retention

Offering health insurance benefits can make a big difference in attracting and keeping talent. By covering at least 50% of the premium costs, you reduce the burden on your employees, making health coverage more affordable and appealing.

Between 2010 and 2012, about 170,000 to 186,000 small businessesclaimed this credit annually. However, many businesses only received a partial credit because they exceeded the wage or FTE thresholds. For Illinois non-profits, this credit is refundable – even if there’s no taxable income – as long as it doesn’t exceed the income tax withholding and Medicare tax liability. It’s worth noting that refund payments for tax-exempt employers may face sequestration reductions, like the 6.8% cut applied in prior fiscal years.

sbb-itb-a729c26

2. Pay-or-Play Penalties for Large Employers

Eligibility Requirements

If your Illinois business employs 50 or more full-time workers (including full-time equivalents), you’re considered an Applicable Large Employer (ALE). This classification requires you to provide health coverage that meets federal standards – or face penalties. A full-time employee is defined as someone working at least 30 hours per week or 130 hours per month. To sidestep the harshest penalties, you need to offer Minimum Essential Coverage (MEC)to at least 95% of your full-time employees and their dependents (children under 26 years old).

But it doesn’t stop there – this coverage must also be considered "affordable." For 2026, employee contributions for self-only coverage cannot exceed 9.96% of their household income. Since employers typically don’t have access to the full scope of an employee’s income, the IRS allows the use of three safe harbors to determine affordability: Form W-2 wages, Rate of Pay, or the Federal Poverty Level (FPL). Meeting these requirements is critical to avoiding costly penalties.

Cost Savings

For large employers, offering compliant health coverage isn’t just about meeting legal standards – it’s also about avoiding hefty penalties. These penalties are steep and non-deductible, making non-compliance a costly mistake. In 2026, failing to provide coverage to at least 95% of full-time employees could result in fines of $3,340 per employee (minus the first 30 employees). If the coverage offered is deemed unaffordable or doesn’t meet minimum value standards, the penalty jumps to $5,010 for each employee who qualifies for a marketplace premium tax credit.

"The significant increase in penalty amounts may make it more important than ever for an ALE to offer affordable, MV health coverage to its FTEs." – The Horton Group

The good news? The 2026 affordability threshold of 9.96% – the highest since the ACA’s inception – gives Illinois employers more room to adjust premium contributions while staying compliant. For example, using the FPL safe harbor, employee contributions can be capped at about $129.90 per month, helping employers avoid penalties. In one real-world example, ACA experts helped a school district avoid $19 million in IRS fines by proving compliance and correcting reporting errors, leading to a full waiver of penalties.

Impact on Employee Retention

Compliant coverage isn’t just about avoiding penalties – it’s also a powerful tool for retaining employees. By offering affordable health benefits, you position your business as a more attractive employer. With enhanced Premium Tax Credits set to expire after 2025, individual marketplace plans are expected to become pricier, making employer-sponsored coverage even more appealing. Employees are far more likely to stick around when they know their health benefits are accessible and cost-effective.

3. Illinois Health Agents Group Plans

Illinois Health Agents brings a deep understanding of the SHOP marketplace, helping small businesses in Illinois take full advantage of ACA tax credits. By pairing federal incentives with expert local guidance, employers can cut costs while offering attractive benefits that help them stay competitive.

Eligibility Requirements

Illinois Health Agents assists small businesses in navigating the Small Business Health Options Program (SHOP)to unlock ACA tax credits. To qualify, your business must meet these criteria:

- Have fewer than 25 full-time equivalent (FTE) employees.

- Pay average annual wages of less than $67,000 per FTEfor the 2025 tax year.

- Contribute at least 50% of the premium costfor employee-only coverage.

Eligible businesses can claim this tax credit for two consecutive tax years.

It’s important to note that owners, partners, and shareholders holding more than 2% of an S corporation, along with their family members, are excluded from FTE and wage calculations. Additionally, businesses under common control must combine employees to determine if they meet the 25-FTE limit. These guidelines provide clarity on how your business can qualify for immediate cost savings.

Cost Savings

The tax credit can cover up to 50% of premium costsfor for-profit businesses and 35% for non-profits. This means that qualifying businesses can effectively cut their premium contributions in half through SHOP-compliant plans.

The highest tax credit is available to businesses with 10 or fewer employeesearning an average of $27,000 or less per year. However, as your workforce grows beyond 10 employees or average wages exceed $33,000, the credit gradually decreases. Illinois Health Agents can help you calculate your potential savings using IRS Form 8941 and ensure your plan qualifies as a Qualified Health Plan (QHP). Beyond the immediate financial benefits, these savings can strengthen your ability to attract and retain talented employees.

Impact on Employee Retention

Offering SHOP coverage through Illinois Health Agents allows small businesses to provide standardized, competitive benefits. This is particularly impactful because, back in 2013, only 34.8% of private-sector firms with fewer than 50 employeesoffered health insurance, compared to 95.7% of firms with 50 or more employees. By subsidizing at least half of your employees’ premiums, you make health coverage more accessible, which can directly improve retention.

With the tax credit offsetting a large portion of costs, small businesses can afford to offer better benefits without stretching their budgets. Employees are more likely to stay when they see their employer investing in their well-being – especially as individual marketplace plans are expected to become more expensive after the enhanced Premium Tax Credits expire in 2025. This investment in employee health not only saves money but also builds loyalty and stability within your workforce.

Pros and Cons

Illinois employers need to weigh the Small Business Health Care Tax Creditagainst pay-or-play compliance, depending on their workforce size. The table below highlights the primary differences between these two options:

| Feature | Small Business Health Care Tax Credit | Pay-or-Play (Large Employers) |

|---|---|---|

|

Employer Size

|

Small Employers: fewer than 25 full-time equivalents (FTEs) | 50 or more FTEs |

|

Cost Savings

|

Covers up to 50% of premium costs (35% for nonprofits) | Avoids penalties by offering coverage; no direct tax credit |

|

Eligibility Requirements

|

Average wages below $67,000; employer must cover 50% of premiums | Must provide affordable coverage with minimum value |

|

Employee Retention Impact

|

High ? subsidized benefits help attract and retain talent in competitive markets | Moderate ? provides baseline coverage to reduce turnover and avoid penalties |

|

Duration

|

Limited to two consecutive tax years | Ongoing as long as the employer qualifies as an ALE |

|

Administrative Burden

|

Requires Form 8941 and use of the SHOP Marketplace | Requires annual Forms 1094-C and 1095-C |

Now, let’s break this down further. For small businesses, the tax credit is most beneficial when they employ 10 or fewer workers, as this allows them to claim the maximum credit. However, the advantage diminishes as the workforce grows beyond 10 FTEs or average wages exceed $33,000.

For large employers, while no tax credit is available, offering compliant health coverage helps avoid penalties and supports workforce stability. Interestingly, over 95% of employers in Illinois have fewer than 50 full-time employees. This means the majority of businesses can focus on leveraging the tax credit rather than worrying about pay-or-play compliance.

It’s worth noting that small employers must reduce their expense deductions by the credit amount. Additionally, tax-exempt organizations experienced a 6.8% refund reductionin fiscal year 2016 due to sequestration. These administrative factors, such as filing specific forms, underline the need for efficient compliance strategies.

For guidance tailored to your business size and growth plans – whether you’re seeking immediate savings through the tax credit or aiming for compliance as you expand – Illinois Health Agents can provide valuable support.

Conclusion

For Illinois employers with fewer than 25 full-time equivalents, the Small Business Health Care Tax Creditoffers a straightforward way to save – covering up to 50% of premium costsfor for-profit companies and 35% for tax-exempt organizations. For instance, a small business with 10 employees could see its premium costs cut in half. This credit is available for two consecutive tax years through the SHOP Marketplace.

Employers with 50 or more full-time employees, however, face a different set of rules. While they don’t qualify for tax credits, they are required to offer affordable coverage to avoid penalties. These penalties will increase in 2026 to $3,340 per employeefor failing to offer coverage or $5,010 per employeefor offering unaffordable coverage. The affordability threshold – set at 9.96% of an employee’s household income– allows larger employers to shift some premium costs to employees while staying compliant.

For businesses with 25 to 49 employees, the situation is unique. They don’t qualify for the tax credit, but they also aren’t subject to pay-or-play penalties. This middle ground means they need to carefully evaluate their options to manage costs effectively.

In short, small businesses can take advantage of immediate tax savings, while larger employers must focus on avoiding penalties and maintaining workforce satisfaction. Navigating these rules can be complex, but Illinois Health Agents are available to help you identify the most cost-effective and compliant health plan for your business.

FAQs

How do I calculate my business’s full-time equivalent (FTE) count?

To figure out your business’s full-time equivalent (FTE) count, start by adding up your full-time employees – those working 30 or more hours per week. Next, total the hours worked by part-time employees in a week. Divide this number by the standard full-time hours (typically 30 hours per week). Finally, combine this result with your full-time employee count. This calculation helps you determine your ACA reporting requirements and whether your business is considered an applicable large employer (ALE).

What expenses can I claim under the Small Business Health Care Tax Credit?

If you’re a small business owner, you can claim expenses for health insurance premiums you pay for your employees. To qualify, you need to cover at least 50% of the employee-only premiums. This credit can ease the financial burden of healthcare costs, offering a helpful way for employers to manage expenses while supporting their team.

Which ACA affordability safe harbor should my company use?

When deciding on an IRS safe harbor, it’s important to pick the one that fits your employee benefits strategy. The most common choices are:

- Federal Poverty Line (FPL) Safe Harbor: This option ensures coverage affordability based on the federal poverty line.

- Rate of Pay Safe Harbor: Affordability is calculated using an employee’s hourly rate or monthly salary.

- W-2 Safe Harbor: This method uses the wages reported in Box 1 of an employee’s W-2 form.

Your selection should align with your company’s specific needs and goals for providing affordable health coverage under ACA guidelines.